Here are four essential tips to help you maximise the. If you’re an australian resident for tax purposes,.

Ato 2025 25 Tax Rates Printable Online, Also calculates your low income tax offset, help, sapto, and medicare levy. This tax calculator provides a general estimate of your tax refund or payable, based on the numbers you enter.

Ato Tax Calculator 2025/25 Melba Simonne, Our simple tax calculator is updated every year. Australian income tax excel spreadsheet calculator.

Ato Tax Rates 2025 Spot Walls, Please enter your salary into the annual salary field and click calculate. Assuming that jeff doesn't have other income, his taxable income for the income year will be $18,000.

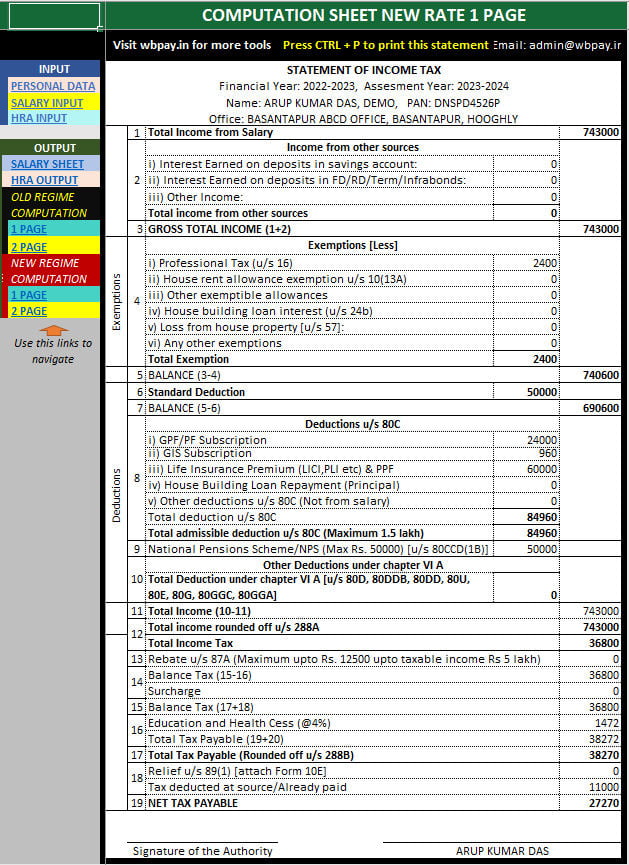

Tax rates for the 2025 year of assessment Just One Lap, Total income ( rs.) 1. The 1st of july 2025 marks the commencement of the stage 3.

Weekly Tax Table Australia 20232024 PDF, ATO Rates, and Codes, The income tax you pay weekly/fortnight/monthly depends on your income minus any immediate deductions like. You can see more details of this amount by selecting show calculation.

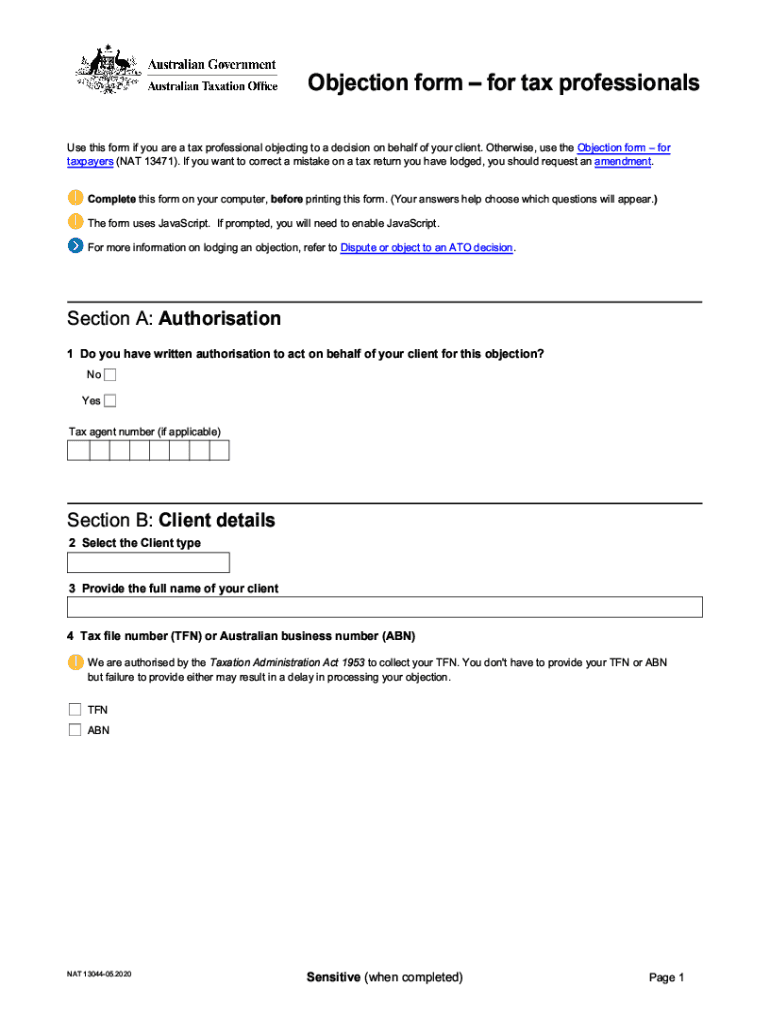

20202024 Form AU NAT 13044 Fill Online, Printable, Fillable, Blank, Mytax will show your estimated tax refund or estimated tax amount owing to the ato. What your take home salary will be when tax and the medicare levy are removed.

2025 Tax Code Changes Everything You Need To Know RGWM Insights, Tax return for individuals 2025. Our calculator will take between 15 and 25 minutes to use.

Irs 2025 Tax Tables Irina Leonora, The income tax you pay weekly/fortnight/monthly depends on your income minus any immediate deductions like. What your take home salary will be when tax and the medicare levy are removed.

2025 Ga Tax Withholding Form, Education cess is applicable @ 4% on income tax. Similarly, for taxpayers earning an annual income of rs.

Tax Calculator For 2025 Tax Year Dona Rochella, You can see more details of this amount by selecting show calculation. Works for 2018, 2019, 2025, 2025 & 2025

Find our most popular calculators and tools listed below or use search and then refine your results using the filters.